HS Code – Is your e-commerce business ready to expand to international shipping? Are you considering importing or exporting products from the UK to the global marketplace? Or using drop shipping to supply your international customers? These are all smart ways to grow your online retail business and reach a larger market.

Before you launch into shipping internationally from the UK, you’ll need to understand the bureaucratic processes involved. This includes knowing the Harmonised System (HS) or tariff codes. HS codes make sure your products reach your international customers efficiently and quickly.

HS codes can take a little while to get your head around. Fortunately, we’ve compiled everything you need to know in one handy document. We’ll help you understand the processes, every step of the way. From how you use HS codes for your international shipping, to why they’re important – here’s your complete guide to HS codes for UK online retailers. Before we start, you might want to check our incoterms guide as well.

This guide covers the following:

- HS codes explained

- How is HS code determined?

- Why is HS code important to UK retailers

- How is an HS code structured and how do I understand them?

- How do I know which country’s tariff codes to use?

- How do I use the HS code correctly?

- Where do I find the correct HS codes?

- Top tips to tackle common challenges with the HS code

HS code explained

The HS code system is an internationally recognised and standardised series of codes. HS codes identify products for import purposes. They are formed of numbers and letters. Each HS code has six digits or more. They are often followed by extra digits. These help identify what a product is, based on its specific features, components, purpose and other factors.

The codes are placed on accompanying documents for customs authorities to inspect for the following reasons:

- They determine tax and tariff rules for your imported products.

- They ensure that there are no bans or restrictions on the products you are importing.

- They enable trade statistics to be monitored.

They are usually included on the commercial invoice for the shipment.

Effective communication is vital when exporting goods from the UK. Both the exporters and importers need to understand their responsibilities. In a globalised marketplace, HS codes help countries all over the world to speak the same language when it comes to global shipping. HS codes enable customs authorities in the US, Brazil, Australia, Sweden and practically anywhere else to identify the contents of an incoming shipment. It’s hard to imagine how UK e-commerce merchants would manage to ship internationally without them.

However, the code system can be very complicated, but it needs to be detailed enough to ensure its effectiveness. However, it’s just a matter of learning the ropes and getting used to the system.

The HS code system covers up to 98% of all products shipped around the world. There are HS codes for everything from teddy bears to laptops. It’s a truly comprehensive system.

With such a wide scope of products, it’s vital that each item can be identified using the right HS code. In short, HS codes are basically your company’s password when entering a foreign market.

How is HS code determined?

The HS system is governed by The International Convention on the Harmonized Commodity Description and Coding System. This is an international trade treaty. The HS system was adopted in 1983 and took effect in 1988. The UK was part of the treaty from the beginning. The aim of HS codes is to standardise customs procedures and ensure a smoother process for importing and exporting throughout the world.

There are 157 ‘Contracting Parties’ (156 countries and the European Union) that make up this treaty today. The World Customs Organisation (WCO) is responsible for the administration of the HS codes. To ensure the HS codes remain current and include all new products, the WCO updates the system every five years.

The World Customs Organisation are also tasked with communicating guidelines to interpret HS Codes. These guidelines help importers and exporters, as well as customs authorities, clarify which HS codes to use.

Why is HS Code important to UK retailers?

Now you know essentially what HS codes are – and the fact that they can be a little tricky to get to grips with – you may be wondering why they are important? And it’s possible you want to know what will happen if HS codes are used incorrectly? For both business and legal reasons, HS codes are incredibly significant in the international shipping process for the following reasons:

The business benefits of using a correct HS code

Ambitious online retailers know that fast delivery is vital for the success of your business. Here are some of the main benefits to using HS codes correctly when exporting from the UK.

- Including correct HS codes helps to identify whether your merchandise has additional tariffs.

- Using the right HS codes reduces the possibility of delays at customs.

- Making sure you include the correct code reduces the chance of incurring extra costs; for either you or the customer.

- Using the right HS codes means customs are less likely to seize or destroy a package.

- Ensuring that your package reaches its destination on time and in great condition helps promote trust in your business. It also helps increase customer loyalty and retention.

- Using the right HS codes helps UK e-commerce retailers control costs and ensure a good standard of service.

So, plenty to like about using the right HS codes, then!

The legal implications associated with incorrectly using HS codes

Usually, it is the importer who needs to make sure they’re using the correct customs declarations, including HS codes. However, in the case of e-commerce, the importer would be the customer who purchases from your online store.

In most cases, everyday online consumers don’t have the faintest idea what an HS code (or a customs document or regulation) is. As a responsible retailer, with your customer’s satisfaction in mind, you should ensure you can fulfil your side of the agreement – delivering the product. Therefore, using the right HS code when exporting from the UK falls under your responsibility, and will help you get your products to your customers without hassle.

Use the incorrect HS classifications could result in you and your customer facing legal consequences, including:

- Fines for non-compliance.

- Seizure of merchandise by customs authorities.

- Denied import.

With the possibility of these risks, it’s best to play things safely. Always include accurate HS codes on your customs documents.

How is an HS code structured and how do I understand them?

As with all new administrative systems, HS codes can seem a little overwhelming at first glance. But don’t worry. This section has everything you need to get to grips with the structure of HS codes, tariff codes and more. You’ll be an HS code pro in no time at all.

A HS code is made up of at least six digits. They are usually written in the format ‘XXXX.XX’. These six digits combine three sets of the hierarchical two-digit codes used in the HS code system.

To find the correct HS code for the product you wish to ship, it’s best to start with the Section numbers. What are they? We cover them in the next section.

For shippers, the process of finding the right HS code for your product starts with the Section numbers.

HS code: section numbers

In order to define the product you’re shipping, you can choose from 21 different Sections. Sections are the broadest categories in the HS code system. For example, Section V (Mineral products), Section II (Vegetable products), and Section XI (Textiles and Textile articles).

Remember: The Section numbers aren’t included in the HS code that you write on your customs document. They are just to help you find the correct code for your products.

Let’s choose an example and break down the steps to finding the correct HS code. Let’s go with apples.

- The first step is to choose the right Section for your product. In the case of apples, it’ll be vegetable products.

- Then simply scroll down the list of products until you find the specific six digit HS code for apples.

Chapter numbers (XXXX.XX)

Chapters have the job of providing more specific categories of the products within the Sections. The Chapters are the first two digits of the product’s HS code. There are 99 different Chapters to choose from when classifying your product, spread out over the 21 Sections.

Returning to our case of apples, the Chapter code is 08, which stands for ‘Edible fruit and nuts; peel of citrus fruit or melons’.

Heading numbers of the HS code (XXXX.XX)

The two digits after the Chapter number refer to the specific ‘Heading’ the product falls under. There are 1,244 Headings to choose from.

One heading under Chapter 08 is 08, which stands for ‘Apples, pears and quinces, fresh’. Now, you’re getting closer to classifying your apples.

Sub-Heading numbers (XXXX.XX)

The final two digits further define your product. These final digits refer to the ‘Sub-Heading’ that your product falls under. There are 5,224 Sub-Headings in the HS code system.

Under Chapter 08, Heading 08, you’ll find Sub-Heading 10: ‘Apples’.

By combining all these numbers, you get the HS code for peaches: 08 + 08 + 10. This number is usually written on customs forms and commercial invoices as ‘0808.10’

HS code: extra digits (XXXX.XX XX XX…)

When shipping to some countries from the UK, you may need to include two or more additional digits to define the product even further. Or there may be other anomalies. This could include the following instances:

- When shipping from the UK to the US, you will need to include additional digits from the US ‘Harmonized Tariff Schedule’ system. These help identify additional specifications about the product which may affect their tax and import status.

- Other countries may have additional code systems are in place. It’s important to check the country in question’s system in advance. For example, for shipments to the US, you can check the U.S. International Trade Commission website.

- There are other countries that use eight-digit code systems, such as Brazil, Argentina, Paraguay and Uruguay. This is called Mercosur Common Nomenclature (NMC). Check the individual country’s site for more details.

- China uses a 13-digit system, which adds seven extra digits to the standard HS codes.

When shipping to Europe or internationally, you will use the HS code in combination with a two-digit Combined Nomenclature (CN) code, followed by a two-digit Integrated Tariff (TARIC) code. Make sure you’re also familiar with how to process EU VAT as Brexit has now changed the process.

How do I know which country’s tariff codes to use?

As we’ve established, some countries use additional digits to the standard six-digit HS codes. So, which country’s codes should I use? The answer is simple: use the system that is standard for the country to which you are shipping to.

For example, when you’re shipping to the US, include the extra digits from the US Harmonized Tariff Schedule. When shipping to Argentina, check the NMC code.

Important note: Following Brexit, HS Codes will be needed for shipping products to EU states when you need to include a commercial invoice with the shipment.

How do I use the HS code correctly?

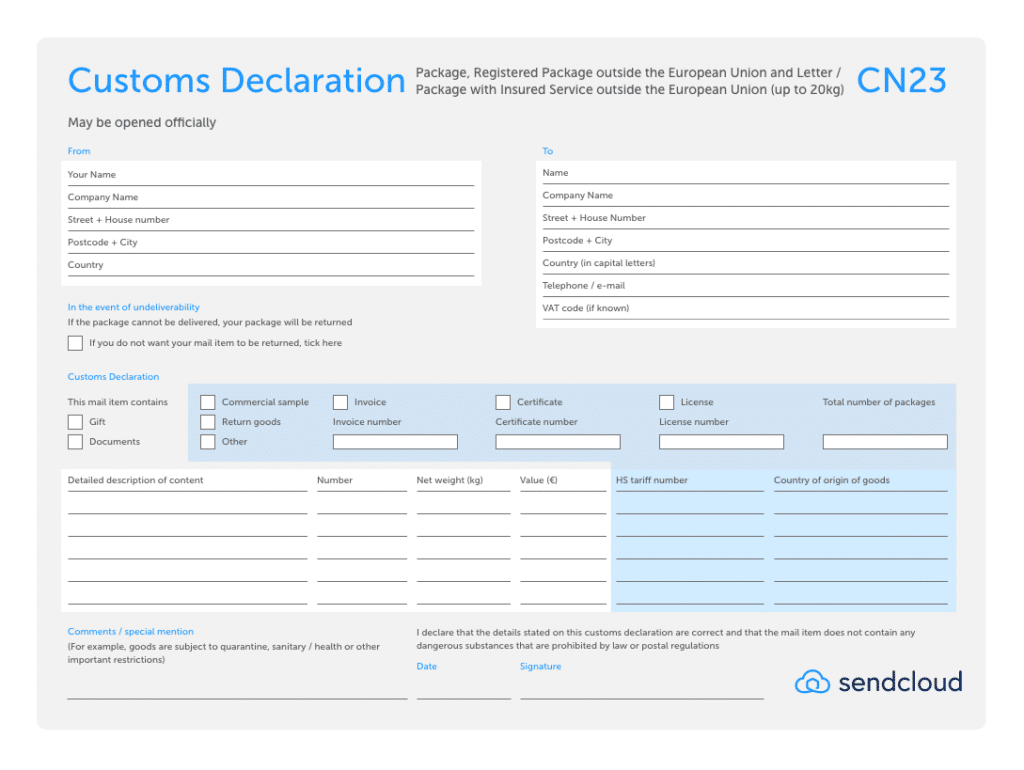

HS codes need to be placed on the commercial invoice and any other required customs documents (such as CN22 and CN23 forms). These documents need to be clearly visible to the customs authorities so need to be attached to the outside of your parcel or freight.

The specific HS code for each product included in the shipment must be in the customs documents attached. Be sure to include the full six-digit code, along with any extra digits required by the destination country.

If you have any doubt about which code to use, refer to guidelines issued by your home country’s customs authorities, or get in contact with the customs authorities of the country to which you are shipping. To save a lot of hassle, we advise you to do a little extra research up front so your product can cross the international border smoothly.

Where do I find the correct HS codes?

Over 200,000 types of products can be identified with the The HS code system. Identifying the correct code can feel like searching for a needle in a haystack.

But don’t despair, we’ve put together this handy HS Code Search Engine that will help you locate the HS code that describes your product best . Simply type in a detailed product name and find the code that’s right for your product.

There are also many search options provided by international couriers. Some even enable you to specify the destination country, so you can see the extra digits that you might need to include.

Top tips to tackle common challenges with the HS code

Like all aspects of importing and exporting, precision is key when it comes to using HS codes. When you first look at the list of HS codes it can be very confusing. With a bit of patience and practice you’ll get used to it in no time at all. The chances are you’ll be using the same codes again and again, so it’ll become second nature soon enough, we promise.

Above all else, you need to make sure you always use the right HS code. Sounds obvious, but many retailers struggle. With this in mind, here are some top tips for tackling common challenges with HS codes.

1: Don’t get stuck paying extra taxes

Your customer could face additional taxes or import duties if you use the wrong HS code. These may not even actually be owed, and this can ultimately damage the relationship with the customer, eliminating the possibility of repeat custom and destroying your competitive edge. Therefore, it’s vital that you always use the correct HS codes to avoid over-taxation. If you’re still in doubt on what the correct code is, it’s best to contact the customs authorities for advice.

2: Avoid incurring taxes later on in the process

Occasionally, customs authorities carry out audits at a later stage and discover errors in your customs documents, despite having initially cleared the products for entry without any questions. This means they will retroactively issue a fine or levy taxes onto your customer. Again, this is a sure-fire way to lose the trust of your customer, and destroy the chance of repeat business. Ensuring your customs documents are completed correctly, including the correct HS codes, to avoid unforeseen fines.

3: Get to grips with the finer details

It’s completely understandable that the HS code system is difficult to navigate, with over 5,000 Sub-Headings to choose from. What makes it even more tricky is the difference between two Sub-Headings is often related to very subtle differences in products. Pay close attention to the wordings of Sub-Headings and whether they specify types of packaging or quantities per package? Choose the Sub-Heading that accurately describes the contents of your package.

4: Keep on top of changes in HS codes

Ensure you are still using the correct HS codes for your products by periodically checking them against the latest HS code list (which is updated every 5 years). Any changes to your products or packaging (like ingredients, materials, components etc) could put your products in a different Sub-Heading.

Conclusion: Getting to grips with HS codes for the benefit of your business

As we’ve mentioned, the HS code system might seem a bit challenging when you first tackle it. But providing you take the time to become familiar with them, the correct use of HS codes can be hugely advantageous to your business. Your products get there on time and in good condition. You avoid unnecessary delays and expenses. This leads to good customer satisfaction, loyalty and retention. What’s not to like?

Need more information on shipping internationally? We have guides covering everything from the EORI number to the rules of origin. Don’t forget to visit our blog to find out more.

When you’re getting to grips with HS codes make sure you check your online resources regularly to ensure you’re using the right codes. Above all, if you’re unsure or need clarification, check with local customs authorities in the countries where you want to do business. Taking that bit of extra time to become confident in the process will pay dividends before you know it. And you can get on with the important business of growing your e-commerce business across the globe. Last but not least: try Sendcloud to optimize your international shipping… You can also book a demo and have a chat with one of our e-commerce experts!

Need help shipping to a particular country?

Check out the following guides for more specific advice on shipping to a particular nation:

If you’re a growing business looking to start shipping across Europe, download our International shipping made easy eBook below!