A commercial invoice is an essential document needed for international shipping – but seeing as you’re here, you probably already know the basics. Now what you need to know is: what does it do, when to use it, and how do you create one? Strap yourself in, this is a techy one.

In this article, we’ll cover:

- What is a commercial invoice?

- When do you need a commercial invoice?

- A commercial invoice example

- How to fill out a commercial invoice

- How to add a commercial invoice to your package

- Create your own commercial invoice with our free template

- A commercial invoice checklist

What is a commercial invoice?

A commercial invoice is a customs document that provides details on a package and its contents.

In a nutshell, the document allows customs officials to:

- Know what’s inside the package

- Apply the correct customs fees and taxes

- Make sure the package meets all legal requirements

- Make sure the package doesn’t contain anything dangerous or banned

If the document is completed correctly, the package will pass through customs without any issues or delays.

When do you need a commercial invoice?

Commercial invoices are mandatory for all international shipments that are sent with an international carrier (like DHL Express or UPS).

Since the UK left the Customs Union, British businesses now also need to supply a commercial invoice when shipping a package to an EU country with an international carrier.

A commercial invoice example

Before we dive into the step-by-step instructions on filling out a commercial invoice, let’s take a quick look at what one looks like.

There are 5 main things to include:

- The sender’s details

- The receiver’s details

- The package’s contents

- The shipping details

- The sender’s signature and date

Don’t confuse the Commercial Invoice for the CN22 or CN23. These are different customs documents that are used when shipping packages internationally with a national courier (like Royal Mail). You can find out more about them in our guide to CN22 and CN23 Customs Declaration forms.

How to fill out a commercial invoice?

There’s no standard layout for a commercial invoice, so you can create yours any way you like. However, the document must contain all the right information.

In this section, we’ll go through all the things you need to include.

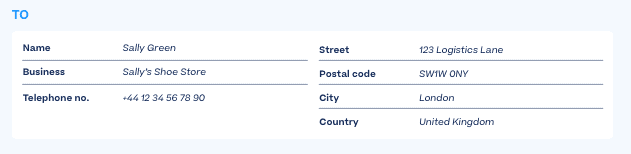

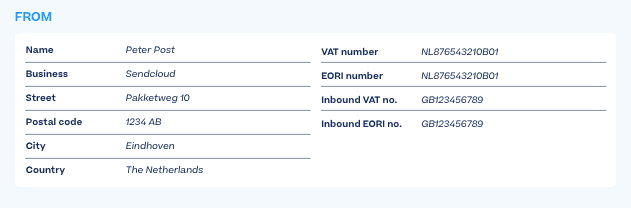

1: Fill in the sender and receiver’s name, address, and details

Start by correctly filling in your business’s name, address, and company information, as well as the name, address, and details of your customer.

It’s wise to clearly separate and label which details are the sender’s and which are the receiver’s.

And most importantly, make sure to include your business’s VAT and EORI numbers.

2: Describe the contents of your shipment

Providing a detailed description of what’s in your package is pretty much one of the key jobs of the commercial invoice.

The description must contain:

- Information about what you are sending

- What the article(s) are made of

- And, if relevant, what their purpose is

List each item separately. Packages are often scanned by customs, and if officers see something that doesn’t match the description, you could be fined.

For each individual item, make sure to include:

- The weight (in KG)

- The value

- The HS Code

- The Country of Origin

- The quantity (e.g. the amount of the particular item in the package)

And don’t forget to include the total weight and the total value of the package’s contents. Remember, even a sample, gift, or return shipment has a value.

HS Codes

The HS Code is essential: for every item you’re shipping, you must write their HS code on the commercial invoice.

HS codes (sometimes referred to as commodity codes) are an international coding system that classifies goods. They help customs authorities know which taxes, duties, and controls to apply to your package. So if you forget to include them, then you can 100% expect your package to be stuck at customs.

The Country of Origin

You also need to include where your products are produced underneath ‘Country of Origin’.

Certain countries request the Country of Origin document for trade policy measures. It’s a good idea to check the local regulations for the country you are shipping to.

3: Fill in the shipping information

The shipping information is also important to mention, including the carrier handling the package delivery, the invoice number, and the tracking information if available.

Incoterms

Your chosen Incoterm must be stated on your Commercial Invoice.

Incoterms (officially named the International Commercial Terms) are standardised international agreements on the transport of goods.

In basic human-speak, they determine who is responsible for the shipping, insurance and customs fees of the package.

If you need more information on Incoterms, we of course have a full guide for everything you need to know to get started.

Category (sometimes called Reason for Export)

It’s also important to include the reason for your shipment. In the case of an e-commerce sale, you’ll generally use “Sale of goods” or “Commercial goods”, but other categories include “Return of sale” or “Gift”.

4: Sign and date the form

Probably the easiest – but most crucial – step, don’t forget to sign and date the form. Without a correct date and signature, the Commercial Invoice won’t be accepted.

And we often see the simplest of things getting forgotten, so make sure to sign and date that form.

How to add a commercial invoice to your package?

It’s generally good to include three copies of the commercial invoice to your shipment.

Why three, you ask? Well if you have three, your package has:

- One for the country you’re exporting from

- One for the country you are shipping to

- And one for the package’s recipient (your customer)

Place two of the forms in a packing list envelope on the outside of the package, then put the final commercial invoice into the package for your customer.

Sendcloud Pro Tip: Make sure to keep a record of all the customs documents for yourself. If there are any mistakes in the handling of the shipment, you can sometimes face high customs fees. But you’re also able to adjust any mistakes in the form once the package is at Customs. Keeping records will help you quickly access the documents to report or alter any mistakes.

Create your own commercial invoice with our free template

So now you’re ready to make your first commercial invoice, let us present to you a way to speed up the process. Introducing our free commercial invoice template to create your very own customs document.

All you need to do is fill in the details of your shipment by following the steps below, and hey-presto, you’ll have your first commercial invoice ready to go.

Commercial invoices: a quick checklist for what you need

Commercial invoices are a vital part of international shipping. They’re the key for customs officials to understand what you’re shipping, which duties and taxes need to be paid, and any other legal requirements that are needed.

When creating your commercial invoices, don’t forget to:

- Include the correct VAT and EORI details for your business

- List each individual item of the package’s contents and include the correct quantity

- Check you include the correct HS Code for each item

- List the Country of Origin for each item

- Include the Incoterm you are shipping with (and make sure that it’s supported by your chosen carrier)

- Sign and date the document

Although Commercial Invoices are a crucial part of international shipping, they’re not the only thing you need to deliver to your worldwide customers.

Whether you’re just getting started with your international journey, or you want to brush up on your international logistics strategy, make sure to check out our complete guide to international shipping below. We cover everything from choosing the right delivery methods to handling international returns.