International Shipping – The sound of a package being posted through the door is familiar to us all with almost 250 billion parcels sent internationally every year. Whatever your interests, open the internet and you’ll find a global marketplace with international deliveries costing a few dollars (or Euros, or pounds). Buying from abroad is no longer rare, it’s part of the reality of being involved in a global marketplace – and we’re all benefitting.

As customers, we expect international shipping to be fast and stress-free, but behind the scenes it’s not easy. Businesses like yours face increased risks, customs, stricter regulations, and managing returns. If that’s not enough, an estimated one in ten parcels go missing, so you’ll need a solid returns policy too.

Whatever your business size, there is a set process to shipping internationally that everyone must follow. This includes the new rules for shipping to Europe after Brexit.

Every business serious about shipping internationally needs a solid strategy in place. There’s no one-size-fits-all, it must be localised, using couriers your customers can trust and backed by rock-solid policies.

If you’re considering shipping internationally, or your business wants to boost global sales, our complete guide to international shipping can help you get things right from day 1.

What makes international shipping different?

International shipping involves sending a parcel outside of your home country. Simple right? Well… not always.

When you send a parcel inside your own country, you’re covered by domestic legislation. When your package crosses country borders, it’s covered by pages and pages of international laws, rules, and regulations. Navigating that is a challenge for anyone (especially those people who don’t love filling in forms).

Shipping outside of a shared economic area is a lot harder, as illustrated by Brexit when the UK left the EU and the strict customs regulations came back into effect between the two entities.

Shipping overseas comes with a complex array of customs regulations and shipping controls that can be hard to navigate. That’s why finding the right partner and developing a targeted strategy is critical to success.

Here are 7 fundamental parts of every international shipping strategy from our international shipping experts.

- 1. Know Your Target Market

- 2. Choose a Shipping Courier

- 3. Understand Legal Requirements

- 4. Get Through Customs

- 5. Pack and label parcels properly

- 6. To insure or not to insure?

- 7. Handle International Returns

International shipping: How to tackle the top 3 challenges?

Don’t want to read the full blog? Check out our video that tackles the top 3 challenges when shipping internationally.

International shipping to Europe (after Brexit)

Before we get into the nitty gritty of the article, let’s address the elephant in the room: Brexit.

You’re probably well aware that the UK left the European Union in the past years. Subsequently, this introduced many changes to how British retailers can sell products into EU countries, including how you need to handle your shipments.

Prior to Brexit, UK retailers could sell products freely anywhere within the EU without having to deal with customs, import VAT or duties. Fortunately, the tariff-free trade deal means no imposed tariffs or duties were imposed on UK goods.

However, following Brexit, all UK businesses still need to treat an international shipment to an EU country like they would treat any other international shipment.

Before you start shipping to the EU, you must ensure you’ve completed the following steps:

- Register for an EORI number. The EORI number is a unique code that is used to track and register customs information within the EU. It is necessary for your international shipments.

- Correctly manage your EU VAT.

- Implement the right procedures for dealing with customs and complete the correct forms. Don’t worry – we’ll cover what you need further down in this article.

- Claim preferential duties if you are able to. Goods must comply with the rules of origin to do this. The rules of origin state that a product must be either wholly obtained from the UK or the EU – so entirely made in the UK or EU – or substantially transformed in such a way that value is added. You must provide a Proof of origin with your shipment to be able to claim the preferential rate of duty, or for customs to allocate the correct duty fees if the product originates from outside the UK and EU.

Now that’s sorted, let’s dive into the 7 fundamental parts of every international shipping strategy.

1. Know your target market for your international shipping

Do you really know your customers? That’s the first question every brand that wants to ship internationally should ask.

The E-commerce Delivery Compass report 2023 shows that successful online retailers are building services around customers, dealing with them on their terms. The average customer is happy spending hundreds of euros online, ordering an average of 1.8 products per month – that’s over 20 online orders per year.

Every online retailer knows that (sadly) not every click results in a sale. What’s the main reason customers abandon their orders? 44% say it’s issues with shipping and delivery options that cause them to click out.

Customers want convenience, but also look to cut costs. 35% say they expect free shipping on orders over €150. However, they’re realistic with 66% understanding that the pandemic has increased shipping costs for all businesses.

The average customer expects delivery within 3-4 days. They’re willing to wait a maximum of 5 days for delivery – potentially longer than we may have thought.

The study illustrates that customers in different territories have different expectations about shipping times, prices, delivery companies, and returns policies. Creating customer profiles that detail expectations enables you to create an attractive and affordable offer. It also enables you to identify territories where you can meet expectations and those you can’t.

While it’s important to identify differences, digital technologies have seen the emergence of a global consumer class with shared expectations. Across all territories, customers expect a “seamless” customer journey from purchase intent to one-click ordering. Invest in understanding your target market before beginning to build your international shipping strategy.

2. Choose a delivery company for your international shipping

Your customer has checked out, now it’s time to get their package in the post.

But, with shipping costs getting higher and higher, you must find the right balance between cost and speed when selecting a courier.

Of course, customers will want the item there as quickly as possible, and if they’re prepared to pay for it. Doing your customer research will help you narrow down the options.

Your ideal international shipping method can heavily depend on your products and customer expectations. If you don’t carefully consider your shipping methods, you could spend too much or miss out on benefits like improved tracking, express delivery, or nominated delivery.

You face three choices of shipping courier:

- Postal services

- Couriers

- Freight forwarders

Let’s look at each in order.

- Postal services

Postal services connect with local international partners to deliver your packages.

- Pros: Cheaper and generally more trusted by customers

- Cons: The package has to be transferred from one another delivery company once it crosses the border. There is less control and visibility with tracking, and claims can take longer.

- Couriers

You can also use international delivery companies with global networks like DHL, DPD, and UPS.

- Pros: Express couriers like these have strong international networks, so they’re faster with increased tracking

- Cons: They generally are more expensive, which increases costs for customers

- Freight forwarders

Freight forwarders are a broker between you (the shipper) and the shipping company.

- Pros: They reduce hassle from the interaction, providing a single solution.

- Cons: Costs can be higher than dealing direct, and your relationship is with the broker, not the delivery company

The choice depends on several factors, including shipping time, reliability, tracking, and overall capabilities. Your choices should be shaped around the requirements and expectations of customers.

Fundamentally, ask yourself: Am I confident the company can get my parcel to the customer quickly enough and safely enough at a price I’m willing to pay?

Calculating shipping costs

Once you’ve determined what products you will be shipping, where you will be shipping them to, and who is responsible for delivering them, you can calculate shipping costs.

International shipping is affected by several factors, including tariffs and taxes, package value, the cost of fuel, shipping method (air, land, or sea), delivery distance, weight and dimensions, and insurance and protection.

Most businesses and brands offer shipping bands to make it simple for customers. This could include splitting parcels into size:

- Small items cost £5 to ship

- Medium items cost £10 to ship

- Large items cost £20 to ship

Using bands simplifies calculations for customers, making it easier for them to see the total cost of goods delivered to their door.

Customers want products at the lowest costs, so every business must do everything it can to minimise shipping costs. Some strategies include negotiating bulk shipping discounts and favourable rates. How successful you are depends on your size.. In most cases, the bigger your business (and the more parcels you send), the larger the discount you can negotiate.

Keep in mind that you can benefit from shipping platforms like Sendcloud that can use their scale and size to pass on bulk discounts and preferential rates. High-growth companies can get access to a simple, cost-effective solution, enabling them to focus attention where it matters – on their customers.

3. Understand the legal requirements of international shipping

There are strict controls about goods that cross borders. You’ll find a list of prohibited items (that can’t be sent under any circumstances) , those that may be restricted (woods covered by CITES for example), and those that need to be clearly labelled (items containing lithium ion batteries, for example).

The responsibility for understanding what you can and can’t ship, and ensuring all the relevant forms are completed is yours. So, double and triple-check whether you can legally send your products.

What are prohibited items?

Every country and courier has different rules as to what is and is not permitted to ship. So, you must research thoroughly before entering a market or using a courier. You’ll need to assure yourself that sending your items is safe and legal.

Here a list of products are you generally not allowed to ship internationally:

- Aerosol sprays

- Alcoholic beverages

- Cigarettes

- Perishable goods

- Petrol or oil

- Fingernail polish

- Perfume and aftershave

- Poison

- Lighters

- Fire extinguishers

- Gas masks

- Lottery tickets

- Rough diamonds

- Damaged Batteries

- Magnets

Next to that, keep in mind that delivery companies can – and do – operate spot checks on parcels that look suspicious. They’ll inspect packages that are:

- Damaged or inappropriately packed

- Have leaks, strange smells, or other signs of inappropriate content

- Are packed poorly or are suspicious

Why do they do this? They are legally responsible for ensuring their operations are safe and above board. Damaged batteries, for example, could catch fire and be potentially catastrophic.

If couriers or customs teams find products that aren’t permitted to be shipped, they will be confiscated or destroyed. You’ll lose the cost of the product and be left with an unhappy customer.

4. Get through customs

It’s critical to be upfront with customers about the fees they will have to pay for importing goods, or you could be accused of misleading them. Costs include import duties, VAT, and processing costs for delivery companies. While you may not be able to provide a calculation accurate to the penny, you can provide an indication of costs for buyers.

Why go to all this effort? If your customer is unaware of these costs, they could refuse the package. This means you could have to pay for the customs costs as well as the costs of returning the package. Even worse, if they’re unhappy they could also trash your reputation online.

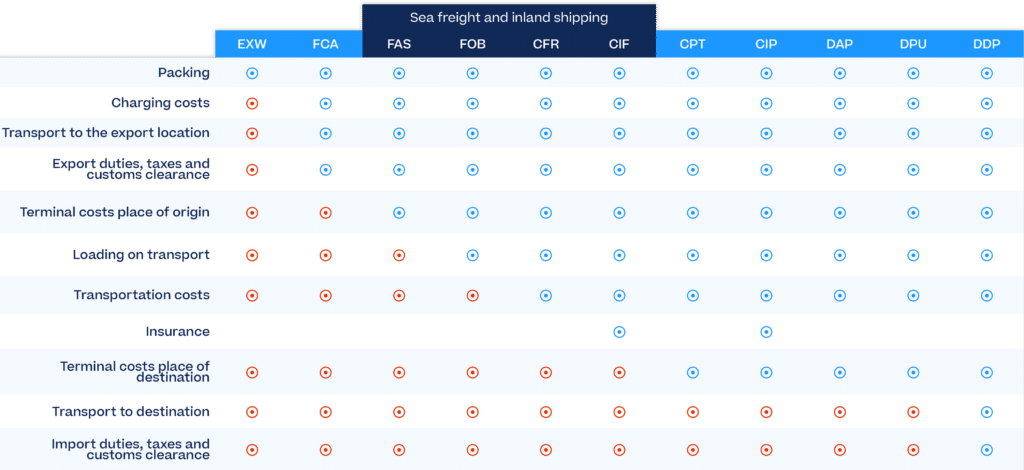

Businesses shipping internationally should develop robust International Commercial Terms (commonly known as Incoterms) that are sent to every customer (or readily available online).

Incoterms have three core functions:

- Cost allocation: They indicate who is responsible for the shipment, insurance, import, and customs costs of the shipment.

- Distribution of obligations: They indicate who is responsible for transport and where to.

- Risk transfer: They indicate who is responsible for the goods in every step of the shipment, including when the risk and costs of the delivery pass from the seller to the buyer.

What customs form do you need?

Depending on the courier and destination, you’ll need to complete a Commercial Invoice, a CN22 or CN23, and a Certificate of Origin when sending international parcels.

- Customs declaration CN22: If you ship with a postal service, you will need to complete a CN22 or CN23 customs form. If you ship products that have a value of up to £270 and weigh below 2KG, you must attach a signed and dated CN22.

- Customs declaration CN23: Include a CN23 when sending goods weighing over 2 kg and/or more than £270 in value. The CN23 declaration is larger than the CN22 declaration and must be attached to the outside of the package in a clear envelope. Include a second copy inside the box as well.

- Despatch Note CP71: This is a mandatory document that accompanies the CN23 declaration.

- Commercial Invoice: Attach a Commercial Invoice to any commercial shipment going overseas. The commercial invoice is a mandatory customs document that includes information about the contents of the package and any agreed terms, such as who pays the customs charges (the Incoterms).

If it sounds like lots of hassle, it is. But there is a solution. Companies can reduce the hassle of managing customs declarations by using automated custom generation. For instance, with Sendcloud you can easily generate a compliant customs form ready to print and to put in your box. The result is zero human errors and a lot of time saved!

5. Pack and label parcels properly

Packing products to send internationally might sound simple enough, but did you know they must be able to withstand a drop of 1.5 metres?

Here are some expert tips on how to package up your parcels to withstand the lumps and bumps of international shipping.

Do…

- Reinforce the corners of your package with packing tape at least 48 mm wide

- Ensure a space of 6 cm between the product and the shipping box

- Fill the package with filling material like bubble wrap or foam peanuts

- Use boxes made of two-ply corrugated cardboard for fragile goods, and add extra protection with layers of bubble wrap

Don’t…

- Avoid using boxes that are too big and heavy, as they’ll cost more to ship

- Don’t use string or twine to seal the box or cover packages in film

- Never use newspapers or other published content to wrap packages. This may be restricted by local censorship rules and could block your package

Establishing a process for packaging international parcels can ensure your goods get to the customer in the best condition. It may take a little time (and cost a little more), but it will keep parcels protected and customers happy.

💡 How to format international addresses

In some countries, addresses may not include a house number, postal code, or even a street name. Delivery companies apply specific formatting on their labels to make sure they can be shipped without a hassle.

It’s up to you to research the information required for the countries you’re shipping to. You’ll have to design your checkout to collect all this information so nothing is missing. (A tip from the pros: Some plugins can autofill addresses to avoid any issues in international shipping.)

Expert tips for correctly addressing international parcels

- Always print the full name of the destination country in capital letters after the name of the recipient’s town or city

- Write the country and city names in English

- Do not include any ISO codes with the postal codes or town/city names, such as FR, D, CH, etc. This may result in errors and delays

How to format your address correctly

- Recipient name

- Street with house number / PO box number

- Postcode and place name

- Country name – in capitals

6. To insure or not to insure?

We all know that accidents happen and parcels go missing, so insurance is vital. Insurance protects you and your customers in the event of an incident with your package.

Some shipping options are insured as a standard for a certain amount. If not, you can take out supplementary insurance through the courier or a third-party provider.

The decision to insure your packages will depend on your attitude to risk and the costs of the items you’re sending.

When considering the cost of offering insurance, think of the signal no insurance sends out. Are you willing to expose your customers to risk – and potentially damage your reputation by not offering extra protection?

💡 Extra protection with Sendcloud insurance

Sendcloud’s Shipping Protection enables you to protect your parcels against loss and damage with easy claims filing, quick refunds. It provides better coverage than standard insurance from the delivery company, giving you confidence.

With the help of Smart Shipping Rules, you can automatically allocate insurance to specific shipments without thinking about it. For example, orders that are all over 200 euros or contain certain products will automatically be assigned insurance.

7. Handle international returns

We hope every customer will be happy, but we know that some won’t. Average e-commerce return rates are a massive 20-30%. Given the hassle and cost, fewer people’s e will want to return international packages – but you’ll still need a process to manage this.

Firstly, are there ways you can improve your process to minimise returns? Some ways you can reduce return include improving packaging to reduce damage, adding customers reviews to provide insights, and offering flexible refund options such as partial refunds.

Do you need to accept international returns? It’s complicated. Countries have different regulations in place for approvals and returns. In Europe, customers get 14 days to return an item. In Australia, there’s no “cooling off” period. However, many brands accept all international returns regardless of whether they’re legally required to do so because it’s better for their business image.

You’re not required to pay for return shipping, but you’ll want to ensure your goods are returned in a saleable condition. If a customer decides to make a return, they should be free to choose how to do so, including selecting a courier and a drop off point. A returns portal, like those operated by Sendcloud, enables you to keep control of your returns process while benefiting from a tried and tested process.

Another great tip is to include a pre-paid returns label in the package. This ensures a safe return, and the cost can be automatically taken off the refund amount.

If you want to remove the hassle completely, there are several options to choose from:

- Outsource returns to a local partner: Your customers can return cheaply to their own country, and your partner can handle all administration and return to your warehouse. You can even let the local partner act as a warehouse so you can locally resell products

- Collaborate with an international logistics party: You make price agreements for both outbound shipments and returns, and you can add a ready-made returns label to the shipments

- International return solutions: Various parties offer complete return solutions on an international level. In Europe, you can use your personal return portal through Sendcloud, available in our all-in-one software and via the API. Using return rules will allow you to set up international returns on your own terms and enable returns for certain products/regions.

Remember that goods returning to your country will need to pass through checks too, and all paperwork will need to be completed to ensure they pass first time (and avoid unnecessary costs!). Working with a returns partner can ensure that this work is done, leaving you to deal with the return and process the payment.

Sendcloud, for example, offers businesses safe and protected returns. Your business can benefit from:

- Comprehensive coverage: Coverage up to £10k for lost and damaged parcels, including sale price and shipping costs.

- Fast claims processing: Easy claim filing and quick resolution with 95% of claims resolved within 24-72 hours of submission. Faster resolution times vs standard delivery company offers.

- Rapid refunds: Receive reimbursement within 48 Hours of claim approval and get back to business as usual.

Conclusion

International shipping can be complex, but it doesn’t need to be. It’s critical that every business sending a product abroad develops a solid strategy that’s based on a detailed understanding of customer requirements, international regulations, and practical considerations about costs.

Red tape, forms, and legal issues can hold every business back from doing what it does best – delighting customers. Of course, you can develop your own international shipping process, but there are huge benefits to working with a partner. Customers can select from multiple couriers with your business benefiting from pre negotiated rates. An easy-to-use online portal makes international returns as simple as possible for customers and businesses. It’s a hassle-free and cost-effective solution.

Ready to take your international shipping to the next level?

Let us show you how! Come for a chat with our experts and learn how you can optimise your shipping processes with Sendcloud.

I would like to start my business from UK to Guinea-Bissau, sending all kind of stuff, and from Guinea-Bissau to UK, I would like to bring Guinea Bissau food. Can you give me more information?

I would like to send some stuff in a faster ways like.

Can you give me more information?

Hi Bernardina,

What exciting news that you’re starting a new business venture! This sounds really interesting, and we’d love to help. The first key to shipping products internationally in a fast and efficient way is to make sure your customs process for both your imports and exports are all in order. This means you shouldn’t face any delays or issues.

But for more tailored information on your shipping process, then I’d suggest getting directly in touch with our product experts. They can help you identify how you can start an efficient international shipping process that won’t let any time be wasted.