A commercial invoice is an essential document needed for international shipping – but seeing as you’re here, you probably already know the basics. Now what you need to know is: what does it do, when to use it, and how do you create one? Strap yourself in, this is a techy one.

In this article, we’ll cover:

- What is a commercial invoice?

- When do you need a commercial invoice?

- A commercial invoice example

- Differences between a commercial invoice and other customs documentation

- How to fill out a commercial invoice

- How to add a commercial invoice to your package

- Create your own commercial invoice with our free template

- A commercial invoice checklist

What is a commercial invoice for international shipping? – A commercial invoice definition

A commercial invoice is a customs document that provides details on a package and its contents. It’s not just a routine piece of paperwork; it plays a crucial role in international trade transactions.

Commercial invoice meaning

Essentially, a commercial invoice acts as a formal request for payment between the buyer and seller for goods or services provided, outlining key details of the transaction, including a description of the goods, their value, quantity, and terms of sale.

In a nutshell, the document allows customs officials to:

- Know what’s inside the package

- Apply the correct customs fees and taxes

- Make sure the package meets all legal requirements

- Make sure the package doesn’t contain anything dangerous or banned

If the document is completed correctly, the package will pass through customs without any issues or delays. Additionally, it acts as a legal document, providing evidence of the transaction and facilitating customs clearance processes.

When do you need a commercial invoice?

A commercial invoice is required in international trade transactions when goods are sold across international borders. They are mandatory for all international shipments that are sent with an international carrier (like DHL Express or UPS).

Since the UK left the Customs Union, British businesses now also need to supply a commercial invoice when shipping a package to an EU country with an international carrier.

Risks of no commercial invoice

Not having a commercial invoice for international shipments can cause problems. Without this document, customs clearance may be delayed or even denied, leading to costly storage fees, returned shipments, or legal penalties. Also, not having one makes it harder to resolve disputes over payment, product quality, and compliance with trade regulations. A commercial invoice helps to avoid risks and make international trade more efficient.

A commercial invoice example

Before we dive into the step-by-step instructions on filling out a commercial invoice, let’s take a quick look at what one looks like.

There are 5 main things to include:

- The sender’s details

- The receiver’s details

- The package’s contents

- The shipping details

- The sender’s signature and date

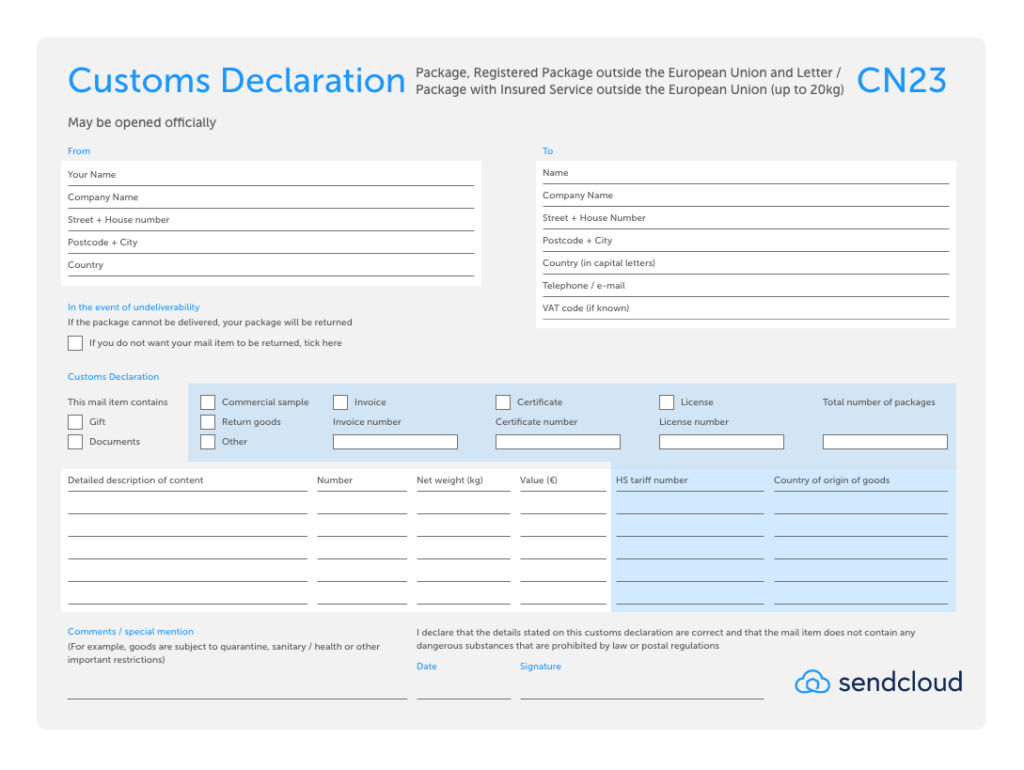

Don’t confuse the Commercial Invoice for the CN22 or CN23. These are different customs documents that are used when shipping packages internationally with a national courier (like Royal Mail). You can find out more about them in our guide to CN22 and CN23 Customs Declaration forms.

Differences between a commercial invoice and other customs documentation

When sending an international package from the UK, you’ll often need several documents. Since Brexit, this applies even when shipping to EU countries, which may be a new requirement for some UK businesses. Sometimes, people get confused about the difference between the commercial invoice and other customs documentation required for international shipments, such as the CN22 and CN23 forms. This confusion is understandable: while both types of documents provide customs authorities with information about the goods being shipped, they serve different purposes and should not be mixed up. So what exactly is the difference? Let’s find out:

Commercial invoice vs. CN22/CN23

A CN22 or CN23 form is a mandatory customs form for all international shipments from the UK. The form is mainly used for shipments that are transported by a postal company. The value or weight of the shipment determines whether you use form CN22 or CN23. The form contains information about the goods being transported and this information is used to determine whether tax must be paid. A CN23 form is always accompanied by a CP71 dispatch note.

A CN22 or CN23 document requires you to fill in a bit more information than the commercial invoice, but the idea behind it is the same. Both documents provide information about the contents of the package so that customs authorities can decide whether the parcel can enter the country, and who is responsible for which taxes and import duties.

As explained above, the commercial invoice is also an export document that you add to all commercial shipments from the UK to any destination. It is a binding customs document that mainly contains information about the contents of the package and the agreements made (Incoterms), such as who pays the customs costs. Based on this document, the customs authorities determine whether import duties have to be paid on the goods.

So when do you use a CN22 or CN23 form, and when do you use a commercial invoice?

- If you’re shipping from the UK using Royal Mail (or another postal service), to any destination, use the CN22 or CN23 customs form. The CN22 or CN23 document is used by the Universal Postal Union and is therefore mandatory for postal services. You must also add a commercial invoice to this kind of shipment.

- If you are using a carrier such as DHL or DPD instead of a postal service, you do not need to add a CN22 or CN23 form.

The main difference is that a commercial invoice is always required for all e-commerce shipments, and only parcels sent via postal services need the additional CN22 or CN23 document.

However, to avoid delays, we recommend that you always add both documents.

Commercial invoice vs. packing list

While a commercial invoice provides detailed information about the contents of a package, including the value, quantity, and terms of sale, a packing list serves a different purpose. The packing list primarily documents the physical contents of the shipment, detailing each item’s dimensions, weight, and packaging type. While both documents aid in customs clearance, the commercial invoice focuses on the financial aspects of the transaction, while the packing list provides logistical information.

Customs invoice vs. commercial invoice

A customs invoice, similar to a Commercial Invoice, is a document required for international shipments to provide customs authorities with essential information about the goods being imported or exported. However, a customs invoice may include additional details specific to customs regulations, such as the country of origin, harmonised tariff codes, and any applicable trade agreements or preferences. While there may be overlap between the two documents, the customs invoice is tailored to meet the specific requirements of customs clearance procedures.

Commercial invoice vs. shipping invoice

While both documents provide details about the goods being shipped, a commercial invoice focuses on the financial aspects of the transaction, such as the value of the goods, payment terms, and the parties involved in the sale. On the other hand, a shipping invoice primarily documents the shipping and handling charges associated with transporting the goods, including freight costs, insurance fees, and any additional surcharges. While complementary, each document serves a distinct purpose in the international trade process, with the commercial invoice emphasising the commercial aspects and the shipping invoice detailing logistical and transportation-related expenses.

How to fill out a commercial invoice?

There’s no standard layout for a commercial invoice, so you can create yours any way you like. However, the document must contain all the right information.

In this section, we’ll go through all the things you need to include.

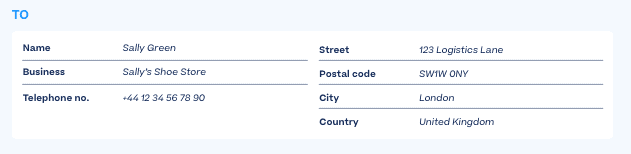

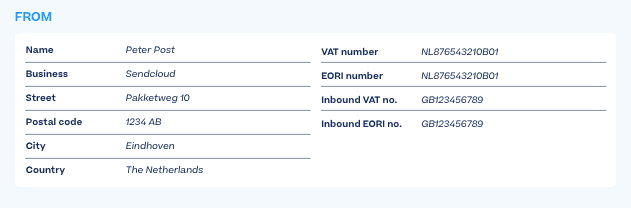

1: Fill in the sender and receiver’s name, address, and details

Start by correctly filling in your business’s name, address, and company information, as well as the name, address, and details of your customer.

It’s wise to clearly separate and label which details are the sender’s and which are the receiver’s.

And most importantly, make sure to include your business’s VAT and EORI numbers.

2: Describe the contents of your shipment

Providing a detailed description of what’s in your package is pretty much one of the key jobs of the commercial invoice.

The description must contain:

- Information about what you are sending

- What the article(s) are made of

- And, if relevant, what their purpose is

List each item separately. Packages are often scanned by customs, and if officers see something that doesn’t match the description, you could be fined.

For each individual item, make sure to include:

- The weight (in KG)

- The value

- The HS Code

- The Country of Origin

- The quantity (e.g. the amount of the particular item in the package)

And don’t forget to include the total weight and the total value of the package’s contents. Remember, even a sample, gift, or return shipment has a value.

HS Codes

The HS Code is essential: for every item you’re shipping, you must write their HS code on the commercial invoice.

HS codes (sometimes referred to as commodity codes) are an international coding system that classifies goods. They help customs authorities know which taxes, duties, and controls to apply to your package. So if you forget to include them, then you can 100% expect your package to be stuck at customs.

The Country of Origin

You also need to include where your products are produced underneath ‘Country of Origin’.

Certain countries request the Country of Origin document for trade policy measures. It’s a good idea to check the local regulations for the country you are shipping to.

3: Fill in the shipping information

The shipping information is also important to mention, including the carrier handling the package delivery, the invoice number, and the tracking information if available.

Incoterms

Your chosen Incoterm must be stated on your Commercial Invoice.

Incoterms (officially named the International Commercial Terms) are standardised international agreements on the transport of goods.

In basic human-speak, they determine who is responsible for the shipping, insurance and customs fees of the package.

If you need more information on Incoterms, we of course have a full guide for everything you need to know to get started.

Category (sometimes called Reason for Export)

It’s also important to include the reason for your shipment. In the case of an e-commerce sale, you’ll generally use “Sale of goods” or “Commercial goods”, but other categories include “Return of sale” or “Gift”.

4: Sign and date the form

Probably the easiest – but most crucial – step, don’t forget to sign and date the form. Without a correct date and signature, the Commercial Invoice won’t be accepted.

And we often see the simplest of things getting forgotten, so make sure to sign and date that form.

How to add a commercial invoice to your package?

It’s generally good to include three copies of the commercial invoice to your shipment.

Why three, you ask? Well if you have three, your package has:

- One for the country you’re exporting from

- One for the country you are shipping to

- And one for the package’s recipient (your customer)

Place two of the forms in a packing list envelope on the outside of the package, then put the final commercial invoice into the package for your customer.

Sendcloud Pro Tip: Make sure to keep a record of all the customs documents for yourself. If there are any mistakes in the handling of the shipment, you can sometimes face high customs fees. But you’re also able to adjust any mistakes in the form once the package is at Customs. Keeping records will help you quickly access the documents to report or alter any mistakes.

Create your own commercial invoice with our free template

So now you’re ready to make your first commercial invoice, let us present to you a way to speed up the process. Introducing our free commercial invoice template to create your very own customs document.

All you need to do is fill in the details of your shipment by following the steps below, and hey-presto, you’ll have your first commercial invoice ready to go.

Commercial invoice FAQ

What is a commercial invoice for customs?

A commercial invoice for customs clearance is a document that provides essential information about the exported goods, including their description, value, quantity, and terms of sale. It is used by customs authorities to assess applicable taxes, duties, and import regulations.

How many copies of a commercial invoice are required?

Typically, at least three copies of a commercial invoice are required for international shipments: one for the exporter, one for the importer, and one for customs authorities.

Who provides the commercial invoice?

The exporter or seller provides the commercial invoice to accompany the shipment.

Is a commercial invoice the same as a sales invoice?

While similar in some aspects, a commercial invoice is specifically used for international trade transactions, providing detailed information about the exported goods for customs clearance. A sales invoice, on the other hand, is primarily used for domestic sales transactions to document the sale of goods or services.

Does a commercial invoice need to be signed?

Yes, a commercial invoice typically needs to be signed by the exporter or their authorised representative to certify the accuracy of the information provided.

Do you need a commercial invoice to ship documents?

In most cases, a commercial invoice is not required for shipments of documents. However, it is advisable to check the specific requirements of the destination country and carrier.

Is a HS code required on a commercial invoice?

Yes, including a Harmonised System (HS) code on a Commercial Invoice is often required for international shipments to classify the goods and determine applicable customs duties and taxes.

Do I need a commercial invoice for returned goods?

Yes, you also may need a commercial invoice for returns, depending on the specific circumstances and the customs regulations of the countries involved. In many cases, a commercial invoice is required to document the value and nature of the returned items for customs clearance purposes. It’s advisable to check with your shipping carrier and the customs authorities of the destination country to determine the specific documentation requirements for returning goods.

Commercial invoices: a quick checklist for what you need

Commercial invoices are a vital part of international shipping. They’re the key for customs officials to understand what you’re shipping, which duties and taxes need to be paid, and any other legal requirements that are needed.

When creating your commercial invoices, don’t forget to:

- Include the correct VAT and EORI details for your business

- List each individual item of the package’s contents and include the correct quantity

- Check you include the correct HS Code for each item

- List the Country of Origin for each item

- Include the Incoterm you are shipping with (and make sure that it’s supported by your chosen carrier)

- Sign and date the document

Although commercial invoices are a crucial part of international shipping, they’re not the only thing you need to deliver to your worldwide customers.

Optimise your international shipments with Sendcloud

Congratulations on mastering the intricacies of commercial invoices! Now, let’s supercharge your shipping process with Sendcloud. Our platform offers a seamless solution for creating and managing shipping documents, including commercial invoices, ensuring compliance and efficiency every step of the way.

Use our intuitive commercial invoice template to easily generate compliant commercial invoices. Simply input the required information, and voila! Your commercial invoice is ready to accompany your shipments, facilitating smooth customs clearance and hassle-free international trade.

But that’s not all! Sendcloud empowers you with a range of tools and features to streamline your shipping operations. From automated order processing to customisable shipping options, our platform offers unmatched flexibility and convenience. Plus, with real-time tracking and notifications, you can keep both yourself and your customers informed every step of the delivery journey.

Ready to take your international shipping to the next level? Learn more about international shipping with Sendcloud today and experience the difference for yourself. Let’s revolutionise your shipping experience together!